According to the Institute for Family Business, there are 4.8 million family businesses in the UK, making up 85% of all businesses and generating over 25% of the country’s GDP.

Tax receipts from family businesses generate more than the entire budget for the NHS! They are vital for the British economy and for families. This makes it even more vital to ensure your business is taken care of when you are no longer around.

Whether you are a 2nd or 3rd generation family business owner or spent your life starting your business from scratch, it is important to get your affairs in order ahead of time.

There are high risks to your business with not adequately planning to pass on your business to your loved ones. Alexis Thomas, experienced Chartered Legal Executive at CJCH Solicitors explores how you can leave your business in your Will. It is never too early or too late to start thinking about your future and the future of those left behind when you are no longer around.

What, if any, impact would your business or shares have if you died without including them in your will?

If your business or shares are not included in your Will, they could end up being sold, broken up or pass as part of the residue of your estate. They may end up with someone who is not able to run the business because of a lack of knowledge and experience. A minor will experience difficulties continuing the business if shares are left to them.

How can a solicitor help you leave a business or shares to someone in your will?

A Solicitor can ensure you direct who the business or shares will end up with. Furthermore, they advise you on who is best to control your business. They can decide the best structure for the Will, such as leaving the business or shares in a discretionary trust. This will give your family the benefit without direct involvement in the business.

Solicitors advise on other options for your business, such as shareholder agreements and life assurance policies. These options protect yours and your business partner’s interests.

Getting proper advice ensures you can continue to control what happens to your business assets and shares once you have passed away.

Do other shareholders have to accept a new shareholder if you leave shares in your will?

The Testator cannot force other shareholders to accept a new shareholder if leaving shares in their Will. Any share transfers in a Will will be governed by shareholder agreements or partnership agreements etc. In this scenario, the likely option is to sell the shares and gift the value, rather than the shares themselves.

What disputes can arise when leaving a business or shares to someone in your will?

The business may face disputes between shareholders if the business position is not effectively considered. If the shareholders cannot reach an agreement, neither shareholder will have control of the company.

Generally, problems will arise in the event the business is left to a minor with no partnership agreement in place. If the decision-making process becomes paralysed, it could end the business, which has serious tax consequences.

What inheritance tax issues should someone leaving a business in their will be aware of?

If someone owns a business, creating their Will in the most tax-efficient way will help minimise Inheritance Tax (IHT). Passing a business in their Will can lead to a large IHT bill.

As a result, the Executors may have to sell the business to pay the IHT bill. Qualification for Business Property Relief (BPR) will allow a person to pass on a part of the business free of tax. However, not all businesses qualify for BPR.

Therefore, the solicitor needs to know everything about the business to advise if BPR applies. Solicitors can advise clients to leave assets that qualify for BPR to other family members such as children so that they are not passed to spouses who are eligible for a different IHT relief.

How we can help:

It is never too early or too late to start thinking about your future, and the future of those left behind when you are no longer around. The team at CJCH has extensive experience in Wills & Probate; Tax & Estate Planning. Get in touch with a member of our team today:

Telephone: 0333 231 6405

Email: privateclients@cjch.co.uk

What are the key things to think about if you have been asked to be an Executor of someone’s Will?

What are the key things to think about if you have been asked to be an Executor of someone’s Will?

In April 2017

In April 2017

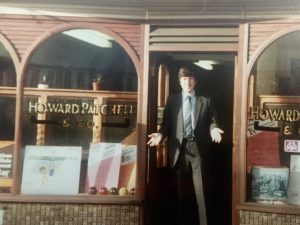

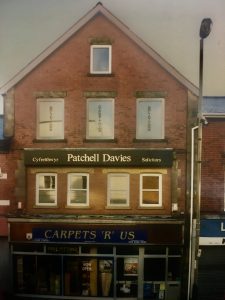

It was in 1992 the firm officially became established as Patchell Davies, the name by which it has been known for nearly three decades, and under which it became a well-known and respected face on the High Street, offering clients a wide range of services.

It was in 1992 the firm officially became established as Patchell Davies, the name by which it has been known for nearly three decades, and under which it became a well-known and respected face on the High Street, offering clients a wide range of services.